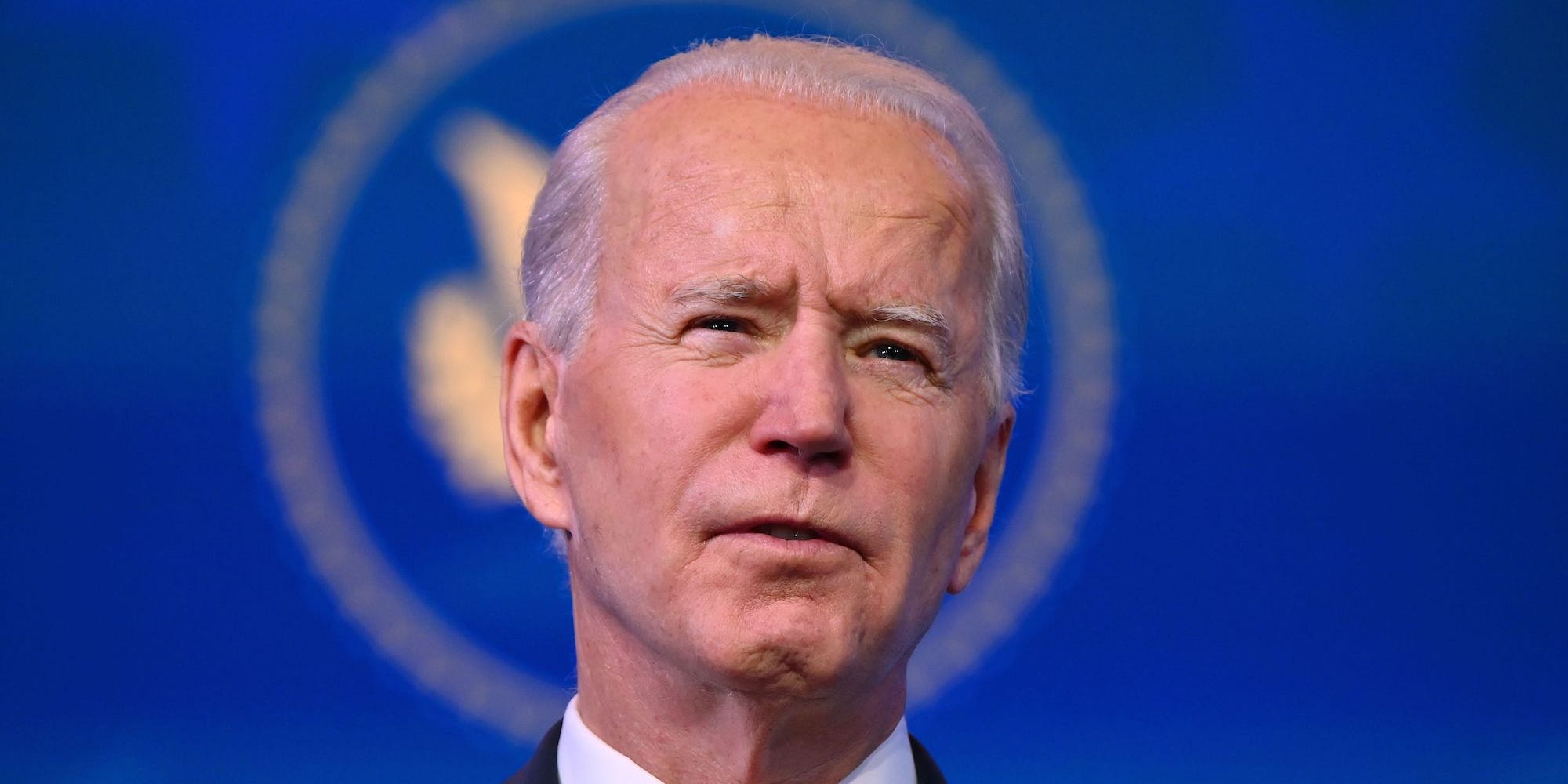

Angela Weiss/AFP

- A new report found that the benefits of Joe Biden’s proposed child allowance is worth eight times its cost.

- The benefits include money back to taxpayers that would result from increases in childrens’ health and earnings.

- Expanding child credits to reduce child poverty has received bipartisan support.

- Visit the Business section of Insider for more stories.

As part of his $1.9 trillion American Rescue Plan, President Joe Biden proposed a conversion of the current child tax credit to a fully refundable child allowance. A new study suggests that would generate about $800 billion in benefits to society.

The report – released on Feb. 18 by the Center on Poverty and Social Policy at Columbia University – found that Biden’s proposal to create a fully refundable child allowance of $3,600 per child aged 0-5, and $3,000 per child aged 6-17, would cost about $100 billion annually, but with $800 billion in benefits.

“With the exceptions of child protective services, criminal justice services, and parent longevity, there are at least two studies for each impact,” the report said. “Together, the impact estimates present a strong and coherent set of results; child allowances are a winning investment in our children’s future mobility.”

Of the $100 billion spent on the child allowances each year, about 60% would go to families with incomes under $50,000, 22% would go to families making between $50,000 and $100,000, and the remaining funds would be distributed to higher income families, according to the report.

Under the current US provided child tax credits, roughly two-thirds of families receive $2,000 per child, but one-third of children are in families whose incomes are too low to receive any credit. The report said that the phasing out of the allowances based on incomes is important because “both common sense and research suggest that children and parents in middle- and upper-income families see their outcomes improve less from an equal increase in family income than do children and parents in lower-income families.”

Here are the benefits to society that would stem from Biden's child allowance, according to the report:

- Children's future earnings increase by $80.6 billion, causing a $16.9 billion reduction in taxpayer costs;

- Increases in children's health gives taxpayers $32 billion in savings in healthcare costs;

- And taxpayers experience gains of $15.1 billion from reductions in child protective service use and criminal justice costs.

And even when generating results for the most restrictive assumptions to show any possible negative impact from the child allowance, the report still found that societal benefits would yield $431.3 billion per year.

"As policymakers consider which social programs to expand, research like this demonstrates the power of programs that directly boost family incomes," a Niskansen Center blog on the report said. "At this point, the case for a child allowance from both a social and economic perspective couldn't be clearer."

According to the Organization for Economic Cooperation and Development, America has one of the highest child poverty rates in the world, and addressing child poverty has received bipartisan support. For example, Sen. Mitt Romney of Utah proposed a plan to provide up to $350 in monthly child benefits, which has a larger price tag than Biden's plan.

—President Biden (@POTUS) February 11, 2021

Romney said in a statement: "Now is the time to renew our commitment to families to help them meet the challenges they face as they take on most important work any of us will ever do - raising our society's children."

Dit artikel is oorspronkelijk verschenen op z24.nl